By using a zero-based budgeting approach, you can gain better control over your finances, ensure that every dollar is put to good use, and prioritize spending according to your financial goals and values. This technique also encourages mindful spending and helps identify areas where expenses can be reduced or eliminated to free up more funds for savings or debt repayment. But what is a Zero-Based Budget, and why should you use one?

A zero-based budget is a budgeting technique where income minus outflow (expenses, debt, savings) equals zero. In other words, every dollar earned is allocated to a specific purpose, whether it's for expenses, savings, investments, or debt repayment, until there's no money left unallocated. This method is really useful for making sure that you are getting the most out of your money! Here's are the steps to follow when creating a zero-based budget:

- Income: Start by listing all sources of income for a given period, such as monthly or bi-weekly income from employment, side hustles and rental properties.

- Expenses: Next, list out all expense categories, including fixed expenses (such as rent, utilities and insurance premiums) and variable expenses (such as groceries, dining out, entertainment). Here it is important to be comprehensive and include all foreseeable expense categories. I highly recommend a small “guilt-free spending category” as a reward for being so good with your finances!

- Debt: After expenses, create a list of all debt categories that you have to pay off. This could include your credit card debt, mortgages, student loans and car loans.

- Savings: Lastly, build a list of long term savings goals (such as retirement, a new car or the deposit for a house) and short term savings goals (such as a holiday or new laptop).

Allocations: Following this, allocate your income to each expense, debt and savings category until the total allocated equals the total income. This may involve prioritizing essential expenses first, such as housing and utilities, followed by discretionary spending and savings goals.

Balance to Zero: After allocating income to all expenses, savings, and debt payments, the goal is for the budget to balance to zero. This means that every dollar earned is accounted for and allocated to a specific purpose.

Adjustments: Throughout the budgeting period, it's essential to track actual spending and compare it to the budgeted amounts. Adjustments may need to be made if there are unexpected expenses, new income or if your priorities change.

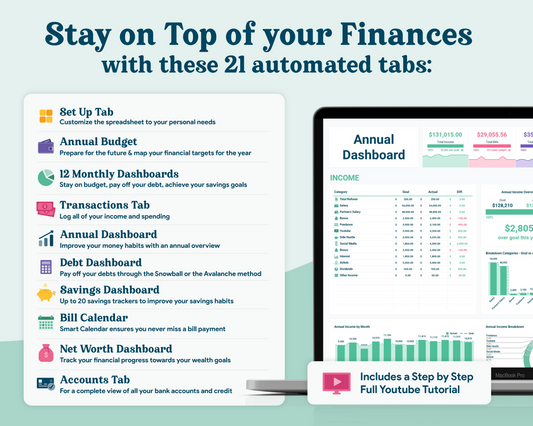

Feeling like this technique might be a bit too complicated for you? No problem! The LowStressLife Zero Based Budget Spreadsheet makes all of this much easier with prompts, streamlined setup, automated formula and clear visuals, allowing you to have fun on your journey towards financial freedom!